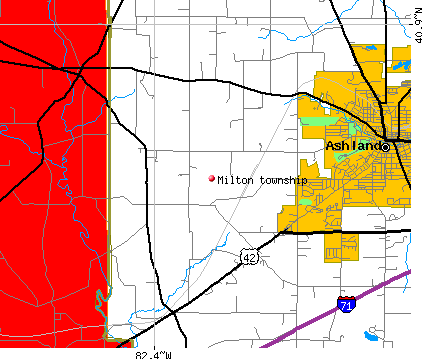

With forty-one thousand parcels, we are one of the largest townships in DuPage County. My office is responsible for locating all taxable property in Milton Township and to establish a taxable value for all property subject to property taxation. I am honored and privileged to serve as your Township Assessor. See our General Property Tax Information and Resources web page for more information.Welcome to the Milton Township Assessor's Office Website The balance is calculated by subtracting the first installment from the total taxes due for the present year. (Elsewhere, a county board may set a due date as late as June 1.) The second installment is prepared and mailed by June 30 and is for the balance of taxes due. In Cook County, the first installment is due by March 1. This installment is mailed by January 31.

Under this system, the first installment of taxes is 50 percent of last year’s tax bill. Cook County and some other counties use this billing method. If the tax bills are mailed late (after May 1), the first installment is due 30 days after the date on your tax bill.Ĭounty boards may adopt an accelerated billing method by resolution or ordinance.

In most counties, property taxes are paid in two installments, usually June 1 and September 1. The phone number should be listed in your local phone book under “County Government.” Contact your county treasurer for payment due dates. The County Treasurer, also called the County Collector, can assist with information on property tax bills or collection of property taxes. The Board of Review can assist with information on filing a complaint on property tax appeals. The Township Assessor with counties under township government or County Supervisor of Assessments Office, also called the County Assessor's Office in some counties, can assist with information on assessment of properties. Individual property tax records are maintained at the local level of government and not by the State of Illinois.

Property taxes are collected and spent at the local level.

The property tax is a local tax imposed by local government taxing districts (e.g., school districts, municipalities, counties) and administered by local officials (e.g., township assessors, chief county assessment officers, local boards of review, county collectors).

0 kommentar(er)

0 kommentar(er)